Ainsworth Game Technology Scheme of Arrangement

Vote NO to Novomatic

What is really going on here?

Novomatic AG has proposed to buy out minority shareholders in Ainsworth Game Technology (ASX: AGI) for $1 per share.

Information about the proposed Scheme of Arrangement urges shareholders to accept the offer, but does not disclose the most compelling reasons why we may elect to vote NO.

This site allows minority shareholders to find out more about the case for a NO vote and share information about the Scheme of Arrangement.

AGI is undervalued at $1 per share

AGI’s property assets are significantly undervalued on the company’s balance sheet.

The independent expert forecasts the company’s 2025 as a Net Profit After Tax of AUD$49M.

But AGI’s share price has been depressed.

Novomatic’s conduct raises questions

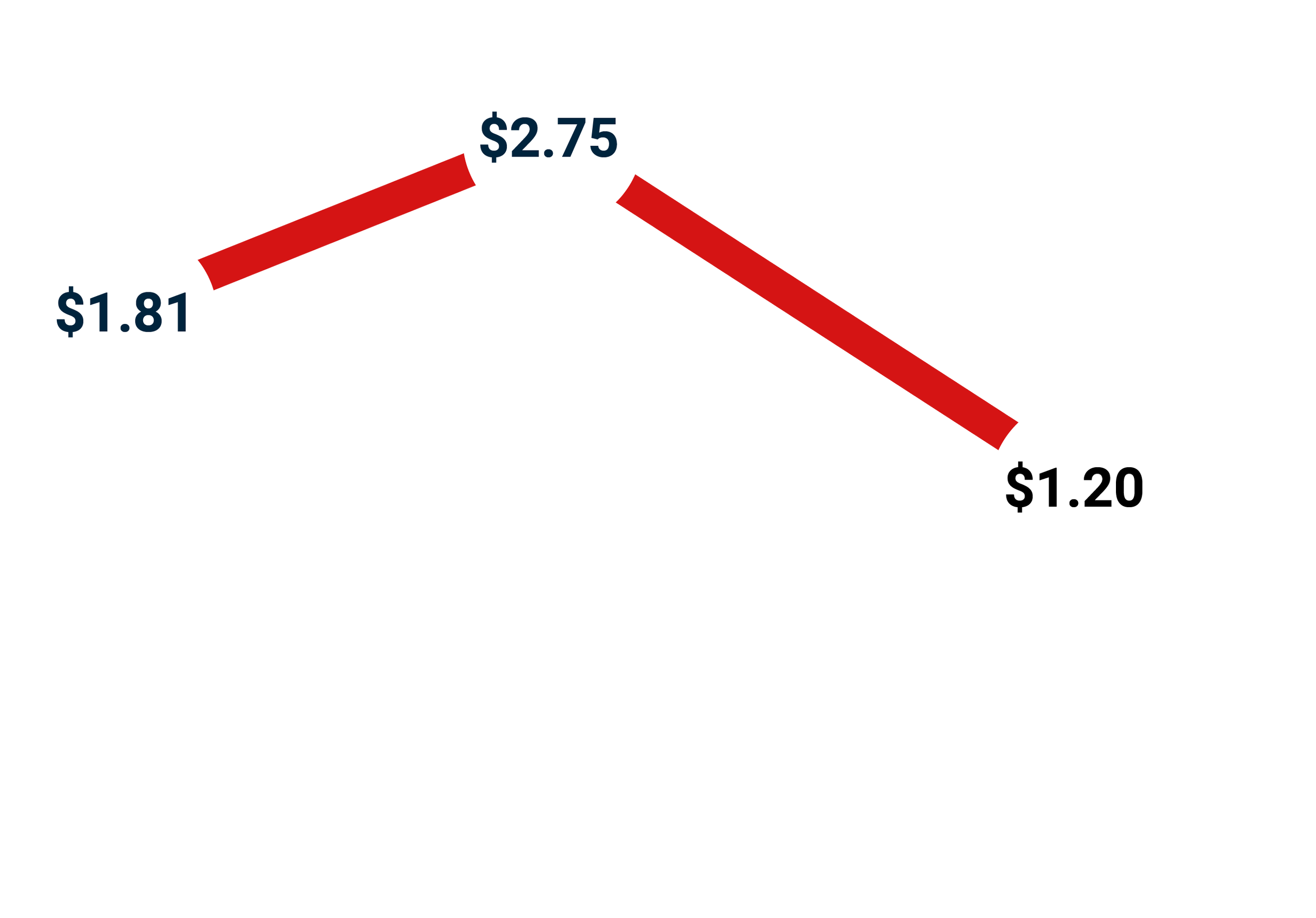

Novomatic’s offer to current shareshareholders is 64% less than it paid to take majority ownership of AGI, and shareholders are right to ask questions about the company’s actions and the timing of the offer.

AGI has excellent prospects

In contrast to the tone of the Scheme Booklet, AGI’s business is highly competitive and does not need a takeover or Novomatic to survive or thrive.